current 15 year refi rates explained for savvy homeowners

What drives the numbers

Current 15-year refinance rates move with bond markets, lender capacity, and your profile. Lenders price using credit score, loan-to-value, property type, and whether you pay discount points. Broader forces-Treasury yields, inflation, and risk appetite-push quotes up or down by the day.

How to read a quote

The note rate is only part of the story; APR folds in fees. Compare the same lock period, points, and cash-out amount. Estimate a break-even: total costs divided by monthly savings shows how long it takes to recoup.

Quick FAQs

- Are rates the same everywhere? No; lenders file unique pricing and adjust for state and loan size.

- When should I lock? After you like the payment and terms; locks protect you for a set window.

- Do points help? Paying points can lower the rate if you’ll keep the loan past break-even.

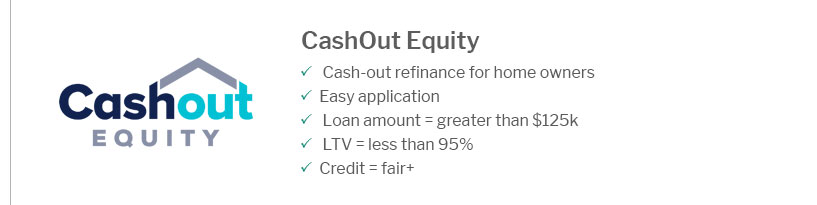

- Is cash-out higher? Usually, yes-expect pricing hits for cash-out and higher LTVs.

- How do I get the best deal? Shop at least three lenders, verify fees, and request a written Loan Estimate.

For the most accurate view of current 15 year refi rates, get personalized quotes the same day and compare them.